Get more information on Telecom Service Assurance Market - Request Sample Report

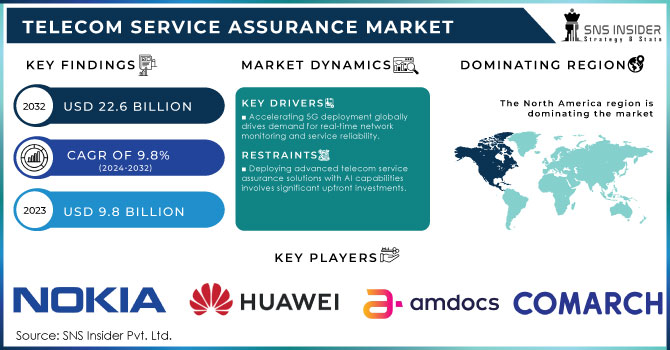

Telecom Service Assurance Market size was valued at USD 9.8 billion in 2023 and is expected to grow to USD 22.6 billion by 2032 and grow at a CAGR of 9.8 % over the forecast period of 2024-2032.

The telecom service assurance market is growing substantially owing to expanding government initiatives to improve telecom infrastructure and access. Recent government statistics show that the global mobile network data traffic increased by 47% in 2023. This increase can be partially attributed to the soaring rate of 5G access and the pervasive growth of the Internet of Things devices. The International Telecommunication Union stated that by the end of 2023, 5.4 billion people were already using the internet, and of this population, 40% relied on mobile networks. In addition, the vast support measures of governments are linked to their ongoing digitalization projects aimed at improving network access in rural and urban areas. The U.S. Government, for example, offered over $65 billion in its broadband Equity, Access, and Deployment program, ensuring small and underserved locations receive high-speed internet by 2030. Another example is the European Union which recently initiated the Digital Decade effort, to make 5G available to 80% of the population by 2025.

The increased network capacity focus of national governments serves the purpose of directly driving the demand for telecom service assurance to enhance and guarantee the quality and reliability of network performance and customer service. At the same time, communication companies face the added pressure of complying with standards and requirements, which also increases investments in assurance. Therefore, telecom assurance providers need to offer solutions that improve service delivery, resilience, and customer satisfaction on top of offering competitive advantages in addressing increasing governmental workloads. Moreover, publicly funded telecom ventures and privately owned communication companies need to upkeep their service delivery pace for the challenges of tomorrow with investment-heavy modern networks and reliance on these ecosystems’ capabilities.

Drivers

Accelerating 5G deployment globally drives demand for real-time network monitoring and service reliability.

Telecom operators use artificial intelligence and automation to optimize service delivery and manage complex networks, these technologies enhance operational efficiency, boosting the demand for advanced assurance systems.

Telecom service assurance helps minimize downtimes and improves service quality, boosting customer retention.

One of the main factors in the growth of the telecom service assurance market is the increased adoption of 5G technology. With the global deployment and expansion of 5G networks, telecom operators have to manage more complex and higher-speed networks. Consequently, to ensure high service quality and the ongoing reliability of their networks, they need advanced service assurance solutions that will assist in preventing and solving various network-related problems.

5G technology offers many benefits, such as ultra-low latency, higher bandwidth, and the ability to connect an enormous number of devices at the same time. However, together with these advantages comes a higher amount of data traffic and the need to monitor the network in real time. For example, the Ericsson Mobility Report states that there were over 1,500 million 5G subscriptions at the end of 2023 and predicts that this number will reach 4,600 million by 2028. Therefore, an increasing number of telecom companies are investing in more advanced service assurance systems that will be able to assist them in handling the increased amount of traffic, reducing network outages and other problems, and better ensuring that the provided services will not be interrupted. For example, Vodafone in Europe uses AI-driven service assurance solutions that continuously monitor its 5G networks and detect faults virtually as they happen, providing a 90% problem resolution rate in real-time at the same time, Verizon has implemented a cloud-native service assurance system in the U.S. that can predict service disruptions before they occur and take them down, thus preventing network outages and assuring good customer experience. Thus, as the adoption of 5G technology is growing, so is the increasing demand to ensure high performance, reliability, and a good user experience with the help of telecom service assurance.

Restraints:

Deploying advanced telecom service assurance solutions with AI capabilities involves significant upfront investments.

Integrating modern telecom service assurance platforms with older legacy infrastructure can be technically challenging.

Telecom operators often have legacy infrastructure that they have built up over years or even decades. These legacy systems are often rigid and based on older technology. They were not designed to be compatible with modern digital solutions. As many advanced telecom service assurance systems use AI, automation, cloud capabilities, etc., integrating them is a significant technical challenge. The new systems must also be able to communicate with the existing tools that operators are using to monitor, analyze, and optimize the performance of their networks. There are often issues with the data flow and a need to integrate the new system into the existing one. The technical complexity of doing so not only slows down the deployment but can increase operational costs as the process requires more time for troubleshooting. Many operators also learn that their legacy systems are not adaptable enough to offer real-time analytics and monitoring, a key capability for maintaining service quality in the fast-paced telecom environment.

By Component

The solution segment led the telecom service assurance market in 2023 and accounted for 61% of the global revenue. The continually rising complexity of telecom networks and surging demand for real-time monitoring and analytics tools prompt the segment growth. Additionally, governments worldwide are pushing towards higher quality of telecom services. For instance, TRAI has mandated tougher service quality norms in 2023, requiring telecom operators to rectify network outages and congestion within 30 minutes of the issue’s occurrence. The regulations prompt the need for telecom service assurance solutions that are capable of automated fault detection, root cause analysis, and end-to-end network performance tracking.

Moreover, the reliance on cloud-based infrastructure further fuels the demand for solutions of such type as they provide centralized monitoring capabilities across a variety of network environments. With the continually rising shift towards 5G networks and hybrid cloud architecture, the tools able to guarantee network seamless operation and highest-quality customer experience become increasingly sought after.

By Enterprise Size

In 2023, the large enterprises segment dominated the market and accounted for the largest share 72% in the telecom service assurance market. Their dominance is driven by the need to manage extensive, complex, and advanced networks. Telecom service assurance tools are vital to large-scale telecom operators, including AT&T and Vodafone, that operate extensive infrastructures and serve millions of customers. According to the U.S. Federal Communications Commission, large enterprises garnered about 78% of the country’s total revenue from the telecom industry. These organizations realize that managing their network’s performance proactively is essential in keeping their operations running seamlessly. As such, they invest in comprehensive, effective tools as their systems are subjected to various regulatory compliance and customer SLAs. Moreover, several governments across different markets are enacting stricter regulations regarding service quality. Therefore, large enterprises have no other option but to include telecom service assurance solutions in their networks. The organizations have the financial resources required to invest in such flexible, scalable tools, which can manage their current and future demands. Moreover, the tools serve multiple applications and games, ensuring that they can stream content and communicate through different devices securely and successfully. Overall, large enterprises have a strong presence in the telecom service assurance market due to their high investments and intensified regulation uncertainties.

By Operator

The fixed operator segment dominated the telecom service assurance market in 2023, with the largest market share. According to ITU data, fixed broadband subscriptions reached over 1.35 billion in 2023, growing by 6.5% from the previous year. The dominance of the fixed operator segment is attributed to the stability and high speed of internet services provided by fiber optic and other fixed broadband technologies, which are popular in high-density urban areas. Moreover, public investments in the expansion of the fixed broadband network are increasing. For example, China’s Ministry of Industry and Information Technology reported over 20% year-over-year increase in optical fiber network installations in 2023 following a similar increase in 2022. According to the same source, the MiIT aims to achieve a 95% broadband penetration rate by 2025. Therefore, the increasing demand for high-quality fixed service by users and businesses drove the fixed operators to deploy the latest available service assurance tools to gain a competitive advantage. Since fixed broadband is a primary source of internet and home entertainment, such as work browsing and streaming and hosting cloud services, the segment is expected to retain its dominance in the market.

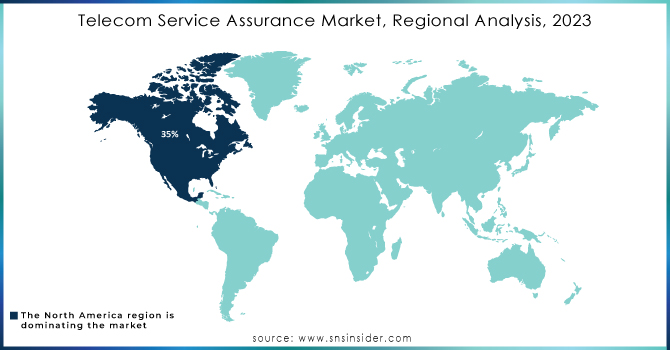

North America was the largest region in the telecom service assurance market in 2023, accounted 35% of the total market share. Early adoption of 5G technology and substantial investments in network infrastructure by the U.S. and Canadian governments have contributed to the region’s market growth. The U.S. Federal Government has focused on modernizing its telecom infrastructure. The government’s investment of over $42 billion in broadband expansion will boost the county’s broadband network as part of the Infrastructure Investment and Jobs Act. Additionally, several prominent telecom service providers have focused on improving their service assurance capabilities as their networks continue to grow more complex. However, the Asia Pacific region is expected to record the fastest CAGR. Investments in 5G networks and the expansion of broadband infrastructure in China, India, and South Korea are the primary drivers of this rapid growth. In 2023, the Chinese Government reported that it had installed 2.1 million 5G base stations to serve more than 75% of the population. The Indian Government’s BharatNet project is also driving market demand. The project’s goal is to connect 250,000 rural villages to high-speed broadband.

Need any customization research on Telecom Service Assurance Market - Enquire Now

In July 2024: Nokia launched an enhanced version of its AVA AI-based telecom service assurance platform with machine learning capabilities, helping automate network operations and improve service quality.

In March 2024: ServiceNow and NVIDIA continued their collaboration by launching Now Assist for Telecommunications Service Management on the Now Platform utilizing NVIDIA AI. The solution allows for enhancing AI-driven, automated processes for telco operations, particularly network management and assurance.

In March 2024: Huawei launched a new 5G service assurance solution based on a partnership with the China Academy of Information and Communications Technology. The new solution is designed to enhance the end-to-end network performance and visibility for both fixed broadband and mobile networks.

Key Service Providers:

Nokia (Nokia AVA, Nokia NetGuard)

Huawei Technologies Co., Ltd. (Huawei SmartCare, Huawei U2020)

Ericsson (Ericsson Expert Analytics, Ericsson Network IQ)

NEC Corporation (NetCracker Service Assurance, NEC iPASOLINK)

Amdocs (Amdocs SmartOps, Amdocs CES)

IBM Corporation (IBM Netcool, IBM SevOne)

Comarch S.A. (Comarch Service Assurance, Comarch OSS Suite)

Accenture (Accenture Intelligent Operations, Accenture Network Assurance)

Tata Consultancy Services (TCS) (TCS Digital Service Assurance, TCS HOBS)

EXFO Inc. (EXFO Nova, EXFO Active Testing)

Key Users of Telecom Service Assurance:

AT&T Inc.

Verizon Communications

Vodafone Group

China Mobile Ltd.

Orange S.A.

BT Group

Deutsche Telekom

Reliance Jio

T-Mobile US

| Report Attributes | Details |

| Market Size in 2023 | US$ 9.8 Bn |

| Market Size by 2032 | US$ 22.6 Bn |

| CAGR | CAGR of 9.8% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments |

• By Component (Solution, Services)

• By Operator type (Mobile Operator, Fixed Operator) • By Deployment Mode (On-Premises, Cloud) • By Enterprise Size (Small and Medium Enterprises, Large Enterprises) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Nokia, Huawei Technologies Co., Ltd., Ericsson, NEC Corporation, Amdocs, IBM Corporation, Comarch S.A., Accenture, Tata Consultancy Services (TCS), EXFO Inc. |

| Key Drivers | • Accelerating 5G deployment globally drives demand for real-time network monitoring and service reliability. • Telecom operators use AI and automation to optimize service delivery and manage complex networks, these technologies enhance operational efficiency, boosting the demand for advanced assurance systems. • Telecom service assurance helps minimize downtimes and improves service quality, boosting customer retention. |

| Market Restraints | • Deploying advanced telecom service assurance solutions with AI capabilities involves significant upfront investments. • Integrating modern telecom service assurance platforms with older legacy infrastructure can be technically challenging. |

Ans: Telecom Service Assurance Market was valued at USD 9.8 billion in 2023.

Ans. The Telecom Service Assurance Market is growing at a CAGR of 9.8 % over the forecast period of 2024-2032.

Ans: Yes, you can buy reports in bulk quantity as per your requirements. Check Here for more details.

Ans: The North American region dominated the Telecom Service Assurance Market in 2023.

Ans:

Table of Contents:

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Adoption Rates of Emerging Technologies

5.2 Network Infrastructure Expansion, by Region

5.3 Cybersecurity Incidents, by Region (2020-2023)

5.4 Cloud Services Usage, by Region

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Type Benchmarking

6.3.1 Type specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new Age Cohort launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Telecom Service Assurance Market Segmentation, By Component

7.1 Chapter Overview

7.2 Solutions

7.2.1 Solutions Market Trends Analysis (2020-2032)

7.2.2 Solutions Market Size Estimates and Forecasts to 2032 (USD Billion)

7.2.3 Probe System

7.2.3.1 Probe System Market Trends Analysis (2020-2032)

7.2.3.2 Probe System Market Size Estimates and Forecasts to 2032 (USD Billion)

7.2.4 Network Management

7.2.4.1 Network Management Market Trends Analysis (2020-2032)

7.2.4.2 Network Management Market Size Estimates and Forecasts to 2032 (USD Billion)

7.2.5 Workforce Management

7.2.5.1 Workforce Management Market Trends Analysis (2020-2032)

7.2.5.2 Workforce Management Market Size Estimates and Forecasts to 2032 (USD Billion)

7.2.6 Fault Management

7.2.6.1 Fault Management Market Trends Analysis (2020-2032)

7.2.6.2 Fault Management Market Size Estimates and Forecasts to 2032 (USD Billion)

7.2.7 Quality Monitoring

7.2.7.1 Quality Monitoring Market Trends Analysis (2020-2032)

7.2.7.2 Quality Monitoring Market Size Estimates and Forecasts to 2032 (USD Billion)

7.2.8 Others

7.2.8.1 Others Market Trends Analysis (2020-2032)

7.2.8.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Services

7.3.1 Services Market Trends Analysis (2020-2032)

7.3.2 Services Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3.3 Professional Services

7.3.3.1 Professional Services Market Trends Analysis (2020-2032)

7.3.3.2 Professional Services Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3.4 Managed Services

7.3.4.1 Managed Services Market Trends Analysis (2020-2032)

7.3.4.2 Managed Services Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Telecom Service Assurance Market Segmentation, By Operator

8.1 Chapter Overview

8.2 Mobile Operator

8.2.1 Mobile Operator Market Trends Analysis (2020-2032)

8.2.2 Mobile Operator Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Fixed Operator

8.3.1 Fixed Operator Market Trends Analysis (2020-2032)

8.3.2 Fixed Operator Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Telecom Service Assurance Market Segmentation, By Deployment

9.1 Chapter Overview

9.2 Cloud

9.2.1 Cloud Market Trends Analysis (2020-2032)

9.2.2 Cloud Market Size Estimates and Forecasts to 2032 (USD Billion)

9.3 On-Premise

9.3.1 Desktops Market Trends Analysis (2020-2032)

9.3.2 Desktops Market Size Estimates and Forecasts to 2032 (USD Billion)

10. Telecom Service Assurance Market Segmentation, By Enterprise Size

10.1 Chapter Overview

10.2 Large Enterprises

10.2.1 Large Enterprises Market Trends Analysis (2020-2032)

10.2.2 Large Enterprises Market Size Estimates and Forecasts to 2032 (USD Billion)

10.3 Small & Medium Enterprises

10.3.1 Small & Medium Enterprises Market Trends Analysis (2020-2032)

10.3.2 Small & Medium Enterprises Market Size Estimates and Forecasts to 2032 (USD Billion)

11. Regional Analysis

11.1 Chapter Overview

11.2 North America

11.2.1 Trends Analysis

11.2.2 North America Telecom Service Assurance Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.2.3 North America Telecom Service Assurance Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.2.4 North America Telecom Service Assurance Market Estimates and Forecasts, By Operator (2020-2032) (USD Billion)

11.2.5 North America Telecom Service Assurance Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.2.6 North America Telecom Service Assurance Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

11.2.7 USA

11.2.7.1 USA Telecom Service Assurance Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.2.7.2 USA Telecom Service Assurance Market Estimates and Forecasts, By Operator (2020-2032) (USD Billion)

11.2.7.3 USA Telecom Service Assurance Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.2.7.4 USA Telecom Service Assurance Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

11.2.8 Canada

11.2.8.1 Canada Telecom Service Assurance Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.2.8.2 Canada Telecom Service Assurance Market Estimates and Forecasts, By Operator (2020-2032) (USD Billion)

11.2.8.3 Canada Telecom Service Assurance Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.2.8.4 Canada Telecom Service Assurance Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

11.2.9 Mexico

11.2.9.1 Mexico Telecom Service Assurance Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.2.9.2 Mexico Telecom Service Assurance Market Estimates and Forecasts, By Operator (2020-2032) (USD Billion)

11.2.9.3 Mexico Telecom Service Assurance Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.2.9.4 Mexico Telecom Service Assurance Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

11.3 Europe

11.3.1 Eastern Europe

11.3.1.1 Trends Analysis

11.3.1.2 Eastern Europe Telecom Service Assurance Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.3.1.3 Eastern Europe Telecom Service Assurance Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.3.1.4 Eastern Europe Telecom Service Assurance Market Estimates and Forecasts, By Operator (2020-2032) (USD Billion)

11.3.1.5 Eastern Europe Telecom Service Assurance Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.3.1.6 Eastern Europe Telecom Service Assurance Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

11.3.1.7 Poland

11.3.1.7.1 Poland Telecom Service Assurance Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.3.1.7.2 Poland Telecom Service Assurance Market Estimates and Forecasts, By Operator (2020-2032) (USD Billion)

11.3.1.7.3 Poland Telecom Service Assurance Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.3.1.7.4 Poland Telecom Service Assurance Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

11.3.1.8 Romania

11.3.1.8.1 Romania Telecom Service Assurance Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.3.1.8.2 Romania Telecom Service Assurance Market Estimates and Forecasts, By Operator (2020-2032) (USD Billion)

11.3.1.8.3 Romania Telecom Service Assurance Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.3.1.8.4 Romania Telecom Service Assurance Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

11.3.1.9 Hungary

11.3.1.9.1 Hungary Telecom Service Assurance Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.3.1.9.2 Hungary Telecom Service Assurance Market Estimates and Forecasts, By Operator (2020-2032) (USD Billion)

11.3.1.9.3 Hungary Telecom Service Assurance Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.3.1.9.4 Hungary Telecom Service Assurance Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

11.3.1.10 Turkey

11.3.1.10.1 Turkey Telecom Service Assurance Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.3.1.10.2 Turkey Telecom Service Assurance Market Estimates and Forecasts, By Operator (2020-2032) (USD Billion)

11.3.1.10.3 Turkey Telecom Service Assurance Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.3.1.10.4 Turkey Telecom Service Assurance Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

11.3.1.11 Rest of Eastern Europe

11.3.1.11.1 Rest of Eastern Europe Telecom Service Assurance Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.3.1.11.2 Rest of Eastern Europe Telecom Service Assurance Market Estimates and Forecasts, By Operator (2020-2032) (USD Billion)

11.3.1.11.3 Rest of Eastern Europe Telecom Service Assurance Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.3.1.11.4 Rest of Eastern Europe Telecom Service Assurance Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

11.3.2 Western Europe

11.3.2.1 Trends Analysis

11.3.2.2 Western Europe Telecom Service Assurance Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.3.2.3 Western Europe Telecom Service Assurance Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.3.2.4 Western Europe Telecom Service Assurance Market Estimates and Forecasts, By Operator (2020-2032) (USD Billion)

11.3.2.5 Western Europe Telecom Service Assurance Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.3.2.6 Western Europe Telecom Service Assurance Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

11.3.2.7 Germany

11.3.2.7.1 Germany Telecom Service Assurance Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.3.2.7.2 Germany Telecom Service Assurance Market Estimates and Forecasts, By Operator (2020-2032) (USD Billion)

11.3.2.7.3 Germany Telecom Service Assurance Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.3.2.7.4 Germany Telecom Service Assurance Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

11.3.2.8 France

11.3.2.8.1 France Telecom Service Assurance Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.3.2.8.2 France Telecom Service Assurance Market Estimates and Forecasts, By Operator (2020-2032) (USD Billion)

11.3.2.8.3 France Telecom Service Assurance Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.3.2.8.4 France Telecom Service Assurance Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

11.3.2.9 UK

11.3.2.9.1 UK Telecom Service Assurance Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.3.2.9.2 UK Telecom Service Assurance Market Estimates and Forecasts, By Operator (2020-2032) (USD Billion)

11.3.2.9.3 UK Telecom Service Assurance Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.3.2.9.4 UK Telecom Service Assurance Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

11.3.2.10 Italy

11.3.2.10.1 Italy Telecom Service Assurance Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.3.2.10.2 Italy Telecom Service Assurance Market Estimates and Forecasts, By Operator (2020-2032) (USD Billion)

11.3.2.10.3 Italy Telecom Service Assurance Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.3.2.10.4 Italy Telecom Service Assurance Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

11.3.2.11 Spain

11.3.2.11.1 Spain Telecom Service Assurance Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.3.2.11.2 Spain Telecom Service Assurance Market Estimates and Forecasts, By Operator (2020-2032) (USD Billion)

11.3.2.11.3 Spain Telecom Service Assurance Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.3.2.11.4 Spain Telecom Service Assurance Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

11.3.2.12 Netherlands

11.3.2.12.1 Netherlands Telecom Service Assurance Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.3.2.12.2 Netherlands Telecom Service Assurance Market Estimates and Forecasts, By Operator (2020-2032) (USD Billion)

11.3.2.12.3 Netherlands Telecom Service Assurance Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.3.2.12.4 Netherlands Telecom Service Assurance Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

11.3.2.13 Switzerland

11.3.2.13.1 Switzerland Telecom Service Assurance Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.3.2.13.2 Switzerland Telecom Service Assurance Market Estimates and Forecasts, By Operator (2020-2032) (USD Billion)

11.3.2.13.3 Switzerland Telecom Service Assurance Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.3.2.13.4 Switzerland Telecom Service Assurance Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

11.3.2.14 Austria

11.3.2.14.1 Austria Telecom Service Assurance Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.3.2.14.2 Austria Telecom Service Assurance Market Estimates and Forecasts, By Operator (2020-2032) (USD Billion)

11.3.2.14.3 Austria Telecom Service Assurance Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.3.2.14.4 Austria Telecom Service Assurance Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

11.3.2.15 Rest of Western Europe

11.3.2.15.1 Rest of Western Europe Telecom Service Assurance Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.3.2.15.2 Rest of Western Europe Telecom Service Assurance Market Estimates and Forecasts, By Operator (2020-2032) (USD Billion)

11.3.2.15.3 Rest of Western Europe Telecom Service Assurance Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.3.2.15.4 Rest of Western Europe Telecom Service Assurance Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

11.4 Asia Pacific

11.4.1 Trends Analysis

11.4.2 Asia Pacific Telecom Service Assurance Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.4.3 Asia Pacific Telecom Service Assurance Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.4.4 Asia Pacific Telecom Service Assurance Market Estimates and Forecasts, By Operator (2020-2032) (USD Billion)

11.4.5 Asia Pacific Telecom Service Assurance Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.4.6 Asia Pacific Telecom Service Assurance Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

11.4.7 China

11.4.7.1 China Telecom Service Assurance Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.4.7.2 China Telecom Service Assurance Market Estimates and Forecasts, By Operator (2020-2032) (USD Billion)

11.4.7.3 China Telecom Service Assurance Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.4.7.4 China Telecom Service Assurance Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

11.4.8 India

11.4.8.1 India Telecom Service Assurance Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.4.8.2 India Telecom Service Assurance Market Estimates and Forecasts, By Operator (2020-2032) (USD Billion)

11.4.8.3 India Telecom Service Assurance Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.4.8.4 India Telecom Service Assurance Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

11.4.9 Japan

11.4.9.1 Japan Telecom Service Assurance Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.4.9.2 Japan Telecom Service Assurance Market Estimates and Forecasts, By Operator (2020-2032) (USD Billion)

11.4.9.3 Japan Telecom Service Assurance Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.4.9.4 Japan Telecom Service Assurance Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

11.4.10 South Korea

11.4.10.1 South Korea Telecom Service Assurance Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.4.10.2 South Korea Telecom Service Assurance Market Estimates and Forecasts, By Operator (2020-2032) (USD Billion)

11.4.10.3 South Korea Telecom Service Assurance Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.4.10.4 South Korea Telecom Service Assurance Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

11.4.11 Vietnam

11.4.11.1 Vietnam Telecom Service Assurance Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.4.11.2 Vietnam Telecom Service Assurance Market Estimates and Forecasts, By Operator (2020-2032) (USD Billion)

11.4.11.3 Vietnam Telecom Service Assurance Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.4.11.4 Vietnam Telecom Service Assurance Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

11.4.12 Singapore

11.4.12.1 Singapore Telecom Service Assurance Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.4.12.2 Singapore Telecom Service Assurance Market Estimates and Forecasts, By Operator (2020-2032) (USD Billion)

11.4.12.3 Singapore Telecom Service Assurance Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.4.12.4 Singapore Telecom Service Assurance Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

11.4.13 Australia

11.4.13.1 Australia Telecom Service Assurance Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.4.13.2 Australia Telecom Service Assurance Market Estimates and Forecasts, By Operator (2020-2032) (USD Billion)

11.4.13.3 Australia Telecom Service Assurance Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.4.13.4 Australia Telecom Service Assurance Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

11.4.14 Rest of Asia Pacific

11.4.14.1 Rest of Asia Pacific Telecom Service Assurance Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.4.14.2 Rest of Asia Pacific Telecom Service Assurance Market Estimates and Forecasts, By Operator (2020-2032) (USD Billion)

11.4.14.3 Rest of Asia Pacific Telecom Service Assurance Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.4.14.4 Rest of Asia Pacific Telecom Service Assurance Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

11.5 Middle East and Africa

11.5.1 Middle East

11.5.1.1 Trends Analysis

11.5.1.2 Middle East Telecom Service Assurance Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.5.1.3 Middle East Telecom Service Assurance Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.5.1.4 Middle East Telecom Service Assurance Market Estimates and Forecasts, By Operator (2020-2032) (USD Billion)

11.5.1.5 Middle East Telecom Service Assurance Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.5.1.6 Middle East Telecom Service Assurance Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

11.5.1.7 UAE

11.5.1.7.1 UAE Telecom Service Assurance Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.5.1.7.2 UAE Telecom Service Assurance Market Estimates and Forecasts, By Operator (2020-2032) (USD Billion)

11.5.1.7.3 UAE Telecom Service Assurance Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.5.1.7.4 UAE Telecom Service Assurance Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

11.5.1.8 Egypt

11.5.1.8.1 Egypt Telecom Service Assurance Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.5.1.8.2 Egypt Telecom Service Assurance Market Estimates and Forecasts, By Operator (2020-2032) (USD Billion)

11.5.1.8.3 Egypt Telecom Service Assurance Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.5.1.8.4 Egypt Telecom Service Assurance Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

11.5.1.9 Saudi Arabia

11.5.1.9.1 Saudi Arabia Telecom Service Assurance Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.5.1.9.2 Saudi Arabia Telecom Service Assurance Market Estimates and Forecasts, By Operator (2020-2032) (USD Billion)

11.5.1.9.3 Saudi Arabia Telecom Service Assurance Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.5.1.9.4 Saudi Arabia Telecom Service Assurance Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

11.5.1.10 Qatar

11.5.1.10.1 Qatar Telecom Service Assurance Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.5.1.10.2 Qatar Telecom Service Assurance Market Estimates and Forecasts, By Operator (2020-2032) (USD Billion)

11.5.1.10.3 Qatar Telecom Service Assurance Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.5.1.10.4 Qatar Telecom Service Assurance Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

11.5.1.11 Rest of Middle East

11.5.1.11.1 Rest of Middle East Telecom Service Assurance Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.5.1.11.2 Rest of Middle East Telecom Service Assurance Market Estimates and Forecasts, By Operator (2020-2032) (USD Billion)

11.5.1.11.3 Rest of Middle East Telecom Service Assurance Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.5.1.11.4 Rest of Middle East Telecom Service Assurance Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

11.5.2 Africa

11.5.2.1 Trends Analysis

11.5.2.2 Africa Telecom Service Assurance Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.5.2.3 Africa Telecom Service Assurance Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.5.2.4 Africa Telecom Service Assurance Market Estimates and Forecasts, By Operator (2020-2032) (USD Billion)

11.5.2.5 Africa Telecom Service Assurance Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.5.2.6 Africa Telecom Service Assurance Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

11.5.2.7 South Africa

11.5.2.7.1 South Africa Telecom Service Assurance Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.5.2.7.2 South Africa Telecom Service Assurance Market Estimates and Forecasts, By Operator (2020-2032) (USD Billion)

11.5.2.7.3 South Africa Telecom Service Assurance Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.5.2.7.4 South Africa Telecom Service Assurance Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

11.5.2.8 Nigeria

11.5.2.8.1 Nigeria Telecom Service Assurance Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.5.2.8.2 Nigeria Telecom Service Assurance Market Estimates and Forecasts, By Operator (2020-2032) (USD Billion)

11.5.2.8.3 Nigeria Telecom Service Assurance Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.5.2.8.4 Nigeria Telecom Service Assurance Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

11.5.2.9 Rest of Africa

11.5.2.9.1 Rest of Africa Telecom Service Assurance Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.5.2.9.2 Rest of Africa Telecom Service Assurance Market Estimates and Forecasts, By Operator (2020-2032) (USD Billion)

11.5.2.9.3 Rest of Africa Telecom Service Assurance Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.5.2.9.4 Rest of Africa Telecom Service Assurance Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

11.6 Latin America

11.6.1 Trends Analysis

11.6.2 Latin America Telecom Service Assurance Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.6.3 Latin America Telecom Service Assurance Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.6.4 Latin America Telecom Service Assurance Market Estimates and Forecasts, By Operator (2020-2032) (USD Billion)

11.6.5 Latin America Telecom Service Assurance Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.6.6 Latin America Telecom Service Assurance Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

11.6.7 Brazil

11.6.7.1 Brazil Telecom Service Assurance Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.6.7.2 Brazil Telecom Service Assurance Market Estimates and Forecasts, By Operator (2020-2032) (USD Billion)

11.6.7.3 Brazil Telecom Service Assurance Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.6.7.4 Brazil Telecom Service Assurance Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

11.6.8 Argentina

11.6.8.1 Argentina Telecom Service Assurance Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.6.8.2 Argentina Telecom Service Assurance Market Estimates and Forecasts, By Operator (2020-2032) (USD Billion)

11.6.8.3 Argentina Telecom Service Assurance Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.6.8.4 Argentina Telecom Service Assurance Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

11.6.9 Colombia

11.6.9.1 Colombia Telecom Service Assurance Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.6.9.2 Colombia Telecom Service Assurance Market Estimates and Forecasts, By Operator (2020-2032) (USD Billion)

11.6.9.3 Colombia Telecom Service Assurance Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.6.9.4 Colombia Telecom Service Assurance Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

11.6.10 Rest of Latin America

11.6.10.1 Rest of Latin America Telecom Service Assurance Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.6.10.2 Rest of Latin America Telecom Service Assurance Market Estimates and Forecasts, By Operator (2020-2032) (USD Billion)

11.6.10.3 Rest of Latin America Telecom Service Assurance Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.6.10.4 Rest of Latin America Telecom Service Assurance Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

12. Company Profiles

12.1 Nokia

12.1.1 Company Overview

12.1.2 Financial

12.1.3 Product / Services Offered

12.1.4 SWOT Analysis

12.2 Huawei Technologies Co., Ltd.

12.2.1 Company Overview

12.2.2 Financial

12.2.3 Product / Services Offered

12.2.4 SWOT Analysis

12.3 Ericsson

12.3.1 Company Overview

12.3.2 Financial

12.3.3 Product / Services Offered

12.3.4 SWOT Analysis

12.4 NEC Corporation

12.4.1 Company Overview

12.4.2 Financial

12.4.3 Product / Services Offered

12.4.4 SWOT Analysis

12.5 Amdocs

12.5.1 Company Overview

12.5.2 Financial

12.5.3 Product / Services Offered

12.5.4 SWOT Analysis

12.6 IBM Corporation

12.6.1 Company Overview

12.6.2 Financial

12.6.3 Product / Services Offered

12.6.4 SWOT Analysis

12.7 Comarch S.A.

12.7.1 Company Overview

12.7.2 Financial

12.7.3 Product / Services Offered

12.7.4 SWOT Analysis

12.8 Accenture

12.8.1 Company Overview

12.8.2 Financial

12.8.3 Product / Services Offered

12.8.4 SWOT Analysis

12.9 Tata Consultancy Services (TCS)

12.9.1 Company Overview

12.9.2 Financial

12.9.3 Product / Services Offered

12.9.4 SWOT Analysis

12.10 EXFO Inc.

12.10.1 Company Overview

12.10.2 Financial

12.10.3 Product/ Services Offered

12.10.4 SWOT Analysis

13. Use Cases and Best Practices

14. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments:

By Component

By Operator

By Deployment

By Enterprise Size

Request for Segment Customization as per your Business Requirement: Segment Customization Request

REGIONAL COVERAGE:

North America

Europe

Asia Pacific

Middle East & Africa

Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

The 3D CAD Software Market size was valued at USD 10.93 billion in 2023 and is expected to reach USD 19.82 billion by 2032 and grow at a CAGR of 6.82% over the forecast period 2024-2032.

The Cloud Data Security Market size was valued at USD 33.39 Billion in 2023 and is expected to reach USD 117.62 Billion by 2032, growing at a CAGR of 15.04% over the forecast period 2024-2032.

The 5G Fixed Wireless Access Market was valued as USD 32.97 Billion by 2023 & will reach at USD 652.43 Bn by 2032 & grow at a CAGR of 39.36% by 2024-2032.

The GCC in the Retail and Consumer Goods Market size was USD 19.1 Billion in 2023, Will Reach to USD 76.9 Bn by 2032 & grow at a CAGR of 15.1% by 2024-2032.

The Virtual Reality in Healthcare Market Size was USD 3.20 billion in 2023 and will reach USD 46.40 Bn by 2032, growing at a CAGR of 33.30% from 2024-2032.

3D Printing Market Size was valued at USD 21.1 billion in 2023 and is expected to reach USD 118.9 billion by 2032, growing at a CAGR of 21.2 % over the forecast period 2024-2032.

Hi! Click one of our member below to chat on Phone